WELCOME TO GST e-LEARNING !

Why e-Learning?

Our Mission

Our Vision

Our Structure

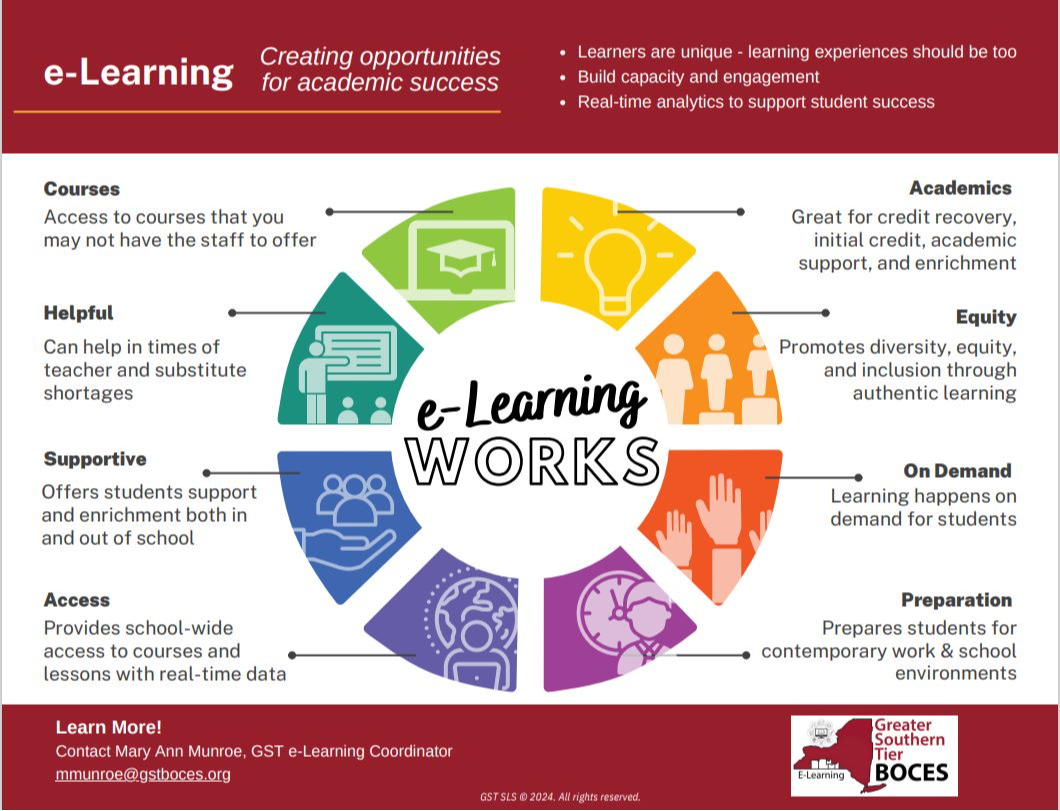

e-Learning provides opportunities to increase student success by offering a variety of resources to our districts including:

Initial Credit

Credit Recovery

Virtual Tutoring

GST e-Learning can offer core content, electives, health, CTE, arts, PE, LOTE, and more. Virtual platforms offer consistent access to students and staff for a common curriculum which engages, supports, and enriches in-person learning. GST can also supply a virtual teacher of record for almost any subject.

Contact Mary Ann Munroe for more information about how e-learning can help grow your academic reach in your schools.

Our mission is to foster a virtual culture of high quality, collaborative, data-informed, cost effective, innovative, flexible, and inclusive teaching and learning opportunities that develop college, career, and civic-ready graduates.

We see our virtual leaning spaces as equitable, safe, inviting spaces where the expertise of our virtual instructors and innovative programming produces independent learners.

We believe virtual learning creates opportunities for increased access to flexible learning opportunities in our school communities that support, enrich, and build on students’ understanding of all subjects and prepares them for their next steps as a college, career, and civic-ready graduates.

The E-Learning Service is one of the many services offered through the Instructional Support branch of GST BOCES. The current iteration of this service is comprised of the former Online Learning and Distance Learning services.

Budgeting Information:

Schools participating in the E-Learning Service will have one base participation fee (budget code 430.000) and can use a discretionary budget line (430.001) for district-specific expenses.

The base fee to participate in this service is calculated annually based on a districts' previous 2 years RWADA.

The base covers the expenses needed to run the basic service. This includes staffing expenses, technology equipment and supplies, office expenses, membership fees, and other things that are used to benefit all participants or maintain the service.

GST BOCES does not upcharge for resources purchased through this service to our component districts.

Participation in the GST BOCES E-Learning service is available to New York State public school districts.

This program, by NYS CoSER definition, operates from September through June (NYS Criteria Guideline #5587)

Under the current structure, all summer programming is coordinated through the GST BOCES Office of Summer School. Schools who have purchased 12-month subscriptions for online learning platforms or content can use them in the summer months without the direct support of the E-Learning Service. Virtual Teachers provided through the E-Learning service are not available during summer months.